Securing the Charge: China’s Policy-Driven Approach to Maintaining Its Lithium-Ion Dominance

China has taken strategic steps to deter the expansion of lithium-ion production in other countries through primary and secondary supply chain dominance and technology restrictions.

The modern lithium-ion industry was not created out of necessity but from China’s realization that it had fallen too far behind in securing a profitable share of the automotive sector. As such, its ability to support a growing population that was becoming more mobile without a severe dependency on foreign auto manufacturers was coming into question. What China did have, however, was a clear advantage: a low-cost, high-capacity manufacturing base, an opportunity to access cheap foreign raw materials, and a government willing to subsidize industrial expansion. This strategy began taking shape in the late 2000s with initiatives like the “Ten Cities, Thousand Vehicles” program.

China’s definitive answer to how it could carve out a place in the global automotive industry came in 2013 when BYD launched the Qin, its first widely marketed dual-mode plug-in hybrid, building on earlier efforts like the F3DM in 2008. The Qin marked a shift from demonstration to commercial viability, offering a marketable product that appealed to urban consumers. By the end of that decade, the rest of the world had come to realize that China, largely without fanfare, had built and implemented a manufacturing and processing infrastructure that rivaled that of any country, including the United States during the internal combustion engine era.

That infrastructure is now something China is not only leveraging globally but also actively protecting as it works to maintain its lead in lithium-ion and electric vehicle production. China has implemented targeted regulations to address several challenges. These include external factors like President Trump’s trade actions and the Biden administration’s tariffs aimed at encouraging U.S. domestic production. They also target internal issues such as manufacturing and recycling overcapacity, which are coupled with environmental concerns. At the same time, China is focusing on emerging segments of the supply chain, including overseas production and other countries’ growing battery waste recycling capacity.

While it may no longer be able to fully monopolize the industry due to growing competition from Europe, South Korea, Japan, and the United States, as well as concerns over environmental and labor practices at home and abroad, China is taking steps to ensure it remains, in some part, a beneficiary of other countries’ efforts to onshore lithium-ion manufacturing.

Control Through Manufacturing and Raw Material Processing

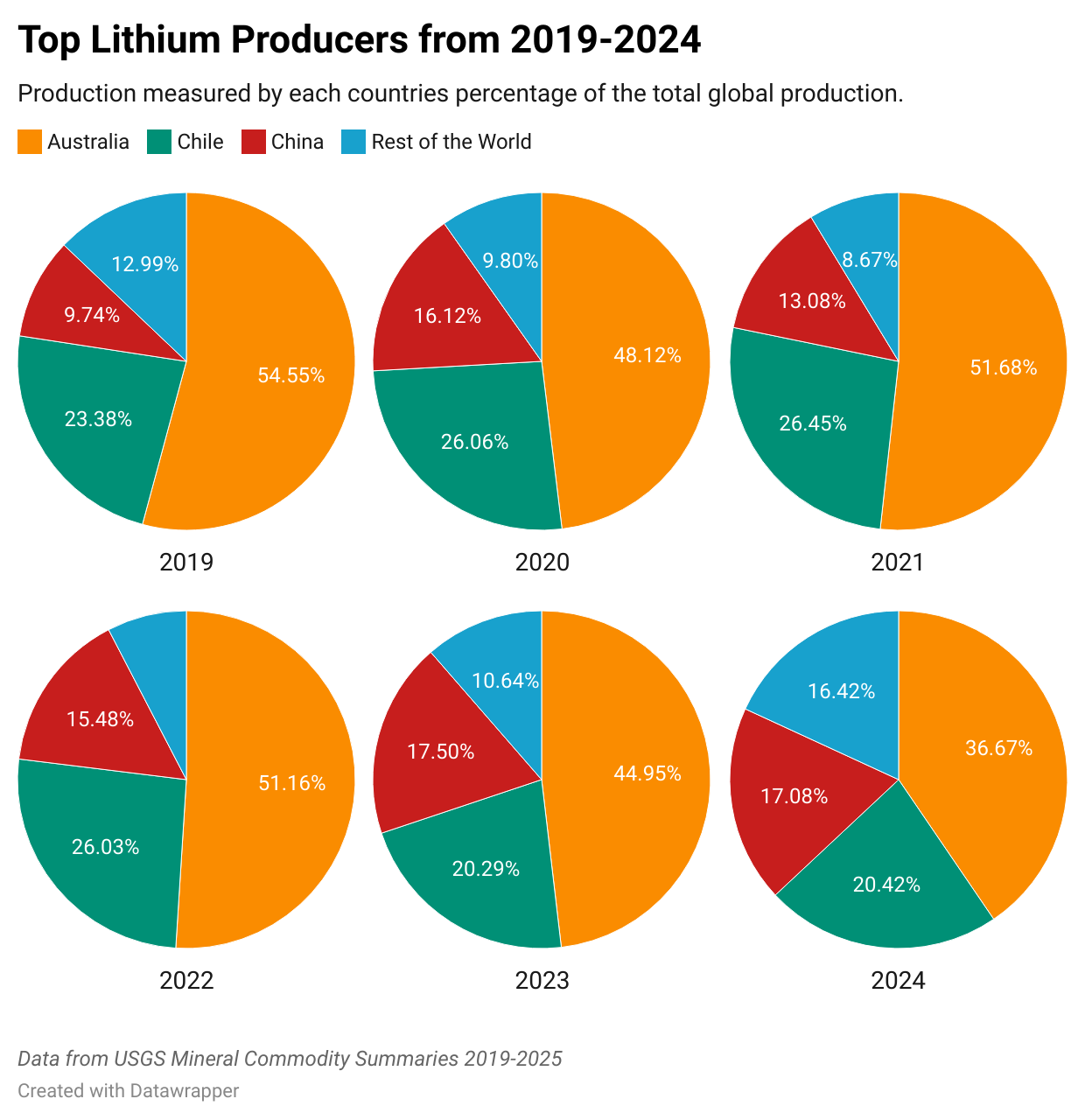

China controls the global lithium supply chain not only through manufacturing and processing but also by influencing raw material extraction through that processing infrastructure. While it produces less than 20% of global lithium from mining, it secures feedstock through long-term contracts, equity stakes, and foreign partnerships, creating an opportunity to access cheap foreign raw materials. This supports facilities that process over 65% of the world’s lithium and produces more than 75% of the batteries used in electric vehicles.