How Oil and Lithium Became Allies in the Critical Minerals War with China

Oil and gas Giants plan to repurpose what is considered waste water to supply the U.S. with lithium, using their decades of oil and gas expertise to break into the battery supply chain.

In the late 1970s and early 1980s, Chevron Resources Company, a subsidiary of Standard Oil of California explored for uranium in the McDermitt Caldera, a massive volcanic complex along the Nevada-Oregon border. The work was part of a broader national push to expand nuclear energy following the 1973 oil crisis. Federal initiatives like Project Independence aimed to reduce dependence on foreign oil and promote domestic energy production

During this exploration, Chevron Resources encountered lithium-rich smectite clays. The company drilled exploratory wells, collected core samples, and submitted data to the U.S. Geological Survey (USGS), which confirmed high lithium content in the region. Some of those original Chevron Resources cores are still stored at the USGS Core Research Center in Denver and are referenced in studies such as Lithium-Rich Claystone in the McDermitt Caldera, Nevada, USA: Geologic, Mineralogical, and Geochemical Characteristics and Possible Origin

At the time of its discovery, lithium was only being researched as the mobile ion for batteries, with no commercial production. Its value to Chevron Resources, which operated the Mount Taylor Uranium Mine in New Mexico, lay in its nuclear applications.

Lithium-6 deuteride (⁶LiD) is used to produce tritium through neutron bombardment, a critical step in thermonuclear weapons development. Lithium-6 hydroxide (⁶LiOH) and lithium-6 carbonate (⁶Li₂CO₃) are used in experimental fusion energy research. Lithium-based molten salts were also tested in reactors such as the Molten Salt Reactor Experiment (MSRE) at Oak Ridge National Laboratory.

Lithium hydroxide monohydrate (LiOH.H2O) created using the lithium-7 isotope—the most common naturally occurring lithium isotope—is used in pressurized water reactors primarily to adjust the coolant’s pH, helping maintain stable reactor chemistry, improve operational stability, and reduce corrosion.

The lithium in Nevada’s sedimentary ore, including the clay deposits Chevron Resources found, formed during the Miocene period (roughly 23 to 5 million years ago). Geothermal water moved through volcanic rocks like rhyolites, picking up lithium along the way. Weathering from rain and wind further broke down these rocks, releasing more lithium into groundwater and streams. That lithium-rich water flowed into closed basins—flat valleys with no outlet—where it mixed with shallow groundwater and ancient lakes to form a salty brine.

Volcanic ash also rich in lithium from nearby eruptions settled into these lakes, creating layers of soft, muddy clay. As the region’s arid climate caused the water to evaporate, lithium from the brine bonded with the ash-rich clay. This process formed the lithium-bearing sedimentary deposits. Over time, tectonic activity buried and preserved these lithium-rich clays.

Chevron Resources’ discovery of these lithium deposits held some commercial potential, but in the 1970s and 1980s, lithium demand was limited to ceramics, lubricants, and niche applications alongside nuclear technology. While the technology to extract metals from clays existed, it would require the modifications of existing platforms and techniques. Chevron Resources pursued this and even secured a patent for their lithium extraction process in 1986. However, brine operations in Chile and Argentina offered cheaper extraction methods, quickly outcompeting other sources. As a result, U.S. lithium production collapsed, leaving only the Silver Peak a brine project in Nevada operational by the early 1990s.

Meanwhile, U.S. nuclear capacity had surged—from less than 1 GW in 1960 to about 55 GW by 1980, then reaching around 100 GW by the late 1980s. But the 1979 Three Mile Island accident changed the industry’s trajectory. Public opposition, strict regulations, and rising costs halted momentum. Over 100 planned reactors were canceled. Uranium prices plummeted. Standard Oil of California in 1984 rebranded itself as the Chevron Corporation and by the start of 1990 the Chevron Corporation had exited uranium—and with it, lithium.

Decades later, the lithium deposits Chevron Resources discovered in the McDermitt Caldera are now viewed as some of the largest volcanic clay lithium resources on Earth. A recent study in Science Advances estimates the Caldera’s claystones contain 20 to 40 million metric tons of lithium —a figure that may exceed the known lithium resource in Bolivia’s Salar de Uyuni, which is around 10.2 million tons of lithium.

What Chevron once left behind is today central to U.S. efforts to establish a secure domestic lithium supply. While the McDermitt Caldera hosts several lithium projects in the exploratory phase, its best-known development is the Thacker Pass Lithium Project, currently under construction.

From the 1990s through the early 2000s, lithium demand remained modest and focused on industrial uses. Chile and Argentina led global supply with low-cost brine operations. Australia began lithium production in the 1980s, notably at Greenbushes, by developing lithium-bearing pegmatite deposits. It was not until the mid-2000s that the market began to shift and demand increased as lithium-ion batteries became more common in electronics.

Growth accelerated in the 2010s with the rise of electric vehicles. China quickly gained dominance in refining and battery manufacturing, triggering concerns over supply concentration and driving renewed interest in U.S. production by the early 2020s.

2023, Chevron Hints at the Return to Lithium.

In July 2023, Chevron CEO Mike Wirth told Bloomberg that lithium extraction fits within the “core capabilities” of a company with decades of subsurface resource development. It was the first time Chevron had publicly discussed the possibility of returning to its decades-old efforts to produce lithium. The announcement followed ExxonMobil’s move into lithium, where it was already deploying their oilfield equipment to target brines in the Smackover Formation of Arkansas and Northeast Texas.

2025, Chevron Makes it Official:

This acquisition represents a strategic investment to support energy manufacturing and expand U.S.-based critical mineral supplies, said Jeff Gustavson, president of Chevron New Energies.

Chevron acquired roughly 125,000 net acres of leases in the Smackover Formation across Northeast Texas and Southwest Arkansas from TerraVolta Resources and East Texas Natural Resources (ETNR) LLC. This marked Chevron’s formal return to the lithium sector. Unlike its earlier work with clays in the McDermitt Caldera, where it developed and then shelved a extraction technology, Chevron is now taking a different approach. Following the same path as ExxonMobil, the company intends to apply its upstream experience and employ the use of direct lithium extraction (DLE) from brines.

Oilfield Brines and Lithium Extraction

Today, brines from sedimentary basins like the Smackover are co-produced during oil and gas operations and often contain higher levels of dissolved lithium than traditional continental brines (salar or salt flat brines). The accumulation of lithium in the Smackover Formation mirrored the same geological process that occurred in Nevada, but instead of closed basins, shallow seas acted as the collection points.

The lithium rich brines like those in the Smackover Formation formed during the Jurassic period (about 200 to 145 million years ago). Geothermal water moved through volcanic rocks like rhyolites, leaching out the lithium before entering a shallow ancient sea. There, it mixed with seawater to form a brine. In the region’s hot, arid climate, the sea partially evaporated, concentrating the lithium within porous limestone layers. Over time, tectonic shifts—just like with sedimentary ore—buried these lithium-rich fluids deep underground in the Smackover Formation.

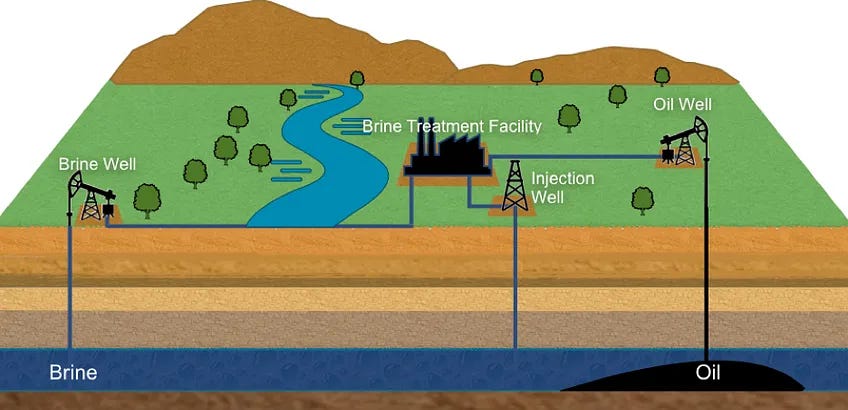

The same porous limestone layers and trapping mechanisms that created and held these lithium-rich brines also served to create reservoirs for hydrocarbons. Over millions of years, organic material deposited in these ancient seas transformed into oil and natural gas, which accumulated in the same rock formations. This geological overlap means oil companies have existing infrastructure—such as wells, pipelines, and processing facilities—that can be adapted to extract lithium from brines alongside hydrocarbons or have new installations put in place to target just the brine.

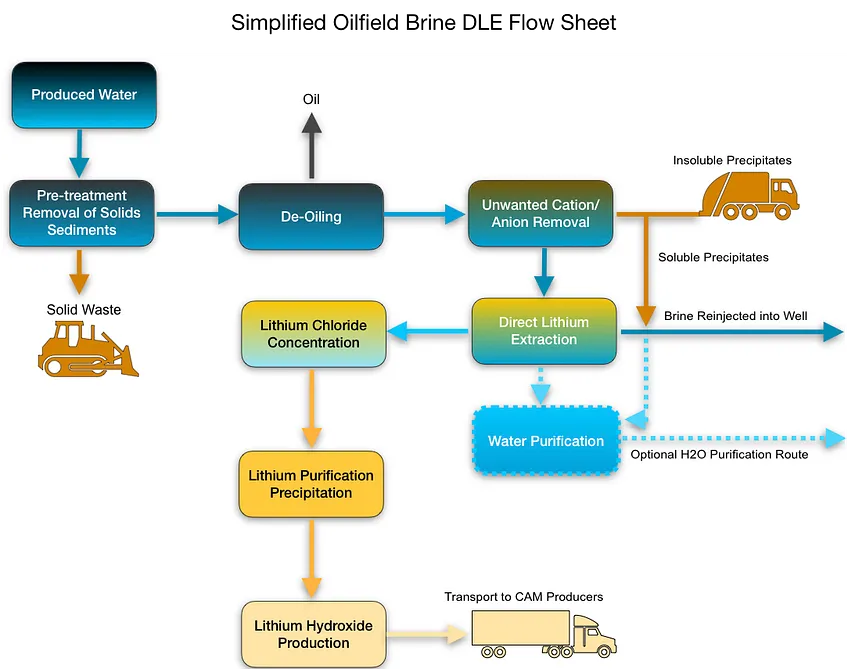

DLE selectively extracts lithium ions from these brines and reinjects the lithium-depleted brine back underground. This approach uses less land. For context Lanxess pushes more than 5 billion gallons of brine annually through three plants in south Arkansas. The Silver Peak lithium mine in Nevada, operated by Albemarle Corporation ALB 0.00%↑ and uses evaporation ponds, currently pumps approximately billion gallons of brine annually. The Silver Peak lithium mine’s operational footprint covers about 4,000 acres, mostly due to the evaporation ponds.

In comparison, a typical bromine extraction site in Arkansas, such as Albemarle’s Magnolia Field, which will be comparable in size to a lithium extraction site, has a much smaller operational footprint and is around 200 acres, comprised of well pads, processing plants, and brine handling infrastructure.

DLE and its water usage are often the focus of debate, driven by a lack of publicly available data and inconsistencies in how water usage and water consumption are reported in public documents and life cycle assessments (LCA). Depending on the need for makeup water and the efficiency of water recovery during extraction and processing, DLE may significantly reduce water consumption compared to traditional brine methods.

Makeup water, which is fresh or treated water added to restore brine volume before reinjection, is sometimes required to maintain reservoir or aquifer pressure, but its use is location dependent and not always necessary. Water is also used to reintroduce soluble impurities removed before extraction so they can be disposed of with the brine back into the reservoir.

Water demand also depends on how much is consumed during lithium extraction and precursor production. Some systems, such as adsorbent-based platforms, use fresh or brackish water to flush lithium from the sorbent, leading to a higher initial water load compared to systems that use a chemical agent like hydrochloric acid. Regardless of the method, most projects report 70–90% water recovery, significantly reducing total consumption.

Additionally, lithium chloride—the intermediate produced through DLE—is often, but not always, converted into a solid for transport. The same applies to precursors. As a result, water is recovered at multiple stages, including concentration and crystallization, which are the final steps in the process.

When it comes to production timelines, DLE greatly accelerates lithium production from years with legacy evaporation ponds to just hours. Alongside faster production, companies that employ DLE platforms, as explained earlier, can leverage existing infrastructure such as wells, pipelines, and processing facilities, making it a cost-effective entry point for oil companies into the lithium market.

For greenfield sites—undeveloped locations with no prior industrial activity—DLE minimizes the need for extensive new infrastructure required for surface mining, reducing capital costs and environmental impact.

However, Arkansas is not a pure greenfield scenario: since the 1950s, bromine has been continuously extracted from Smackover brines via established industrial operations. According to the Arkansas Oil & Gas Commission, operations produced approximately 236 million barrels of brine from Union and Columbia Counties in 2017.

Brownfield sites—locations with existing industrial infrastructure such as abandoned oil or gas fields—benefit significantly from DLE’s ability to repurpose wells, pipelines, and processing plants. For example, a brownfield project could include an existing well where the produced water to hydrocarbon ratio has made the site unprofitable. With DLE, the site can be adapted to target lithium-rich brines, with the hydrocarbon becoming an ancillary stream, extending the site’s profitability decades beyond what was possible with traditional oil and gas extraction.

Another example of a brownfield site is what is happening in the Permian Basin in Texas, where demonstration plants are being placed between the saltwater disposal (SWD) holding tanks and the reinjection pumps. Once the lithium has been extracted, the brine continues on to be disposed of in deep underground reservoirs, utilizing what was waste and adding a secondary revenue stream to the existing oil projects.

DLE allows oil companies to apply their expertise in brine management and pumping infrastructures to the production of lithium. And while both site types benefit from DLE’s rapid deployment, brownfield sites or in the case of Arkansas greenfield sites that exist in am ecosystem with more than a half-century of operations, offer a faster, more cost-efficient path for oil companies entering the lithium market. The U.S. has over 1 million active oil and gas wells, and according to S&P Global, around 60 geological formations contain brines with lithium concentrations above 50 mg/L, suggesting that tens of thousands of wells could potentially support lithium extraction.

Outside of the United States, in Saudi Arabia and the United Arab Emirates, firms like Saudi Aramco are investing heavily in DLE to tap into their oilfield brines and add extraction to their existing oil production. Saudi Arabia plans to use its extensive energy infrastructure to expand into critical minerals and is partnering with the United States and other countries to fully realize what they call Vision 2030.

Occidental and ExxonMobil in the Lithium Industry

Occidental Petroleum OXY 0.00%↑

Occidental is advancing lithium extraction through TerraLithium, a wholly owned subsidiary. TerraLithium is developing DLE technology that draws on Occidental’s oilfield operations and OxyChem’s chemical processing capabilities. The platform targets high-purity lithium recovery from brines with reduced environmental impact.

BHE Renewables Joint Venture: In June 2024, Occidental partnered with BHE Renewables, a Berkshire Hathaway Energy subsidiary, to commercialize TerraLithium’s DLE technology. The project targets geothermal brines in California’s Imperial Valley, where BHE processes 50,000 gallons of brine per minute and generates 345 MW of clean electricity. A demonstration plant began operating in Brawley in 2024 to validate scalability. If successful, BHE plans to construct commercial-scale facilities, with potential for global licensing. The region contains an estimated 18 million metric tons of lithium, enough for more than 375 million EV batteries over the lifetime of the site.

Pure Lithium Partnership: In March 2024, Occidental’s Low Carbon Ventures invested $15 million in Pure Lithium, a Boston-based company developing lithium metal anodes. Occidental handles brine pretreatment, while Pure Lithium processes it into battery-grade lithium metal for use as an anode. The deal strengthens Occidental’s downstream role in the battery supply chain.

Smackover Formation Leases: In October 2024, Occidental acquired full ownership of leases in Arkansas’s Smackover Formation. With Berkshire Hathaway holding 28 to 29% ownership of Occidental and the existing JV with BHE for DLE, they will either participate or at least benefit from this endeavor. Although no active development has been announced, Occidental plans to apply TerraLithium’s DLE platform, which has shown over 99% lithium capture efficiency. As one of the largest brine handlers in the country, the company is well-positioned to operate in the region.

Occidental aims to produce domestic battery-grade lithium carbonate and hydroxide, reducing reliance on foreign sources. CEO Vicki Hollub has stated that lithium supports the company’s low-carbon goals by leveraging its infrastructure and technical expertise to meet growing battery demand.

ExxonMobil XOM 0.00%↑

ExxonMobil is also targeting lithium-rich brines in the Smackover Formation. In February 2023, it acquired over 120,000 gross acres from Galvanic Energy for more than $100 million. By November 2023, the company launched Mobil Lithium, confirming its intention to become a major lithium supplier. Brine is accessed through conventional drilling at 10,000 feet and processed onsite using DLE. The lithium is converted into battery-grade carbonate or hydroxide, and the lithium-depleted brine is reinjected underground.

Partnerships and Progress: In partnership with Tetra Technologies, ExxonMobil is developing 6,138 acres in the Smackover. The Arkansas Oil and Gas Commission (AOGC) approved their joint brine unit in October 2023. Test wells have shown lithium concentrations up to 646 mg/L. A pilot plant in Houston began producing battery-grade lithium in 2024 while evaluating multiple DLE platforms. A final technology selection was expected by year-end 2024, but as so far not announcement has been made. In June 2024, ExxonMobil signed a preliminary offtake agreement with SK On for up to 100,000 metric tons of lithium.

Production Timeline and Goals: Appraisal drilling included eight wells and over 1,000 feet of core samples. First production is targeted for 2026 in partnership with Tetra. Commercial-scale operations are expected in 2027, with a goal of supplying enough lithium for over one million EVs annually by 2030.

ExxonMobil sees lithium as a long-term investment and is positioned to weather the current and any future price volatility. CEO Darren Woods has emphasized they plan to leverage ExxonMobil’s upstream and chemical divisions, with additional offtake agreements.

Conclusion

During the 1970s, oil and gas corporations, alongside major chemical companies like Dow Chemical, led early research into alternative energy and fuel sources. However, by the mid-1980s, following the end of the oil crisis and the decline of nuclear power expansion, that research was largely set aside in favor of innovations focused on fossil fuel production.

More than four decades later, companies like International Battery Metals (IBAT), founded by some of the original Dow Chemical researchers who pioneered DLE, are advancing that foundational work. Meanwhile, Chevron is setting up operations in the Smackover Formation and returning, after a decades long hiatus, to the lithium industry, where they could once again become a source of not only lithium but expand their role as like with the other oil giants branching into lithium production, a strategic asset for the United States.

The oil patch is emerging as an unorthodox battleground for companies competing to secure a domestic lithium supply, with legal challenges over production rights already occurring. But the shift by companies often seen as being at odds with the energy transition to now producing a key mineral that enables it suggests that something larger may be underway. It could signal the start of an effort by the U.S. to push back against China’s dominance in the global lithium market and its dependence on foreign sources.

If you enjoyed this article, please consider becoming a paid subscriber. Your support helps fund work like this and grants you access to exclusive archives and paid articles, where Abe and I explore companies and their projects in much greater detail.

Disclaimer: This article is intended solely for educational purposes only and should not be construed as investment advice, a solicitation to buy or sell securities, or a recommendation of any investment strategy. The author has not received compensation from any companies mentioned and is not responsible for decisions made based on this information. Readers are encouraged to consult primary sources and professional advisors before making investment decisions.

References:

World’s largest lithium deposit found in Nevada-Oregon border (2023) extremetech.com

Occidental and BHE Renewables Form Joint Venture to Commercialize TerraLithium Extraction Technology (2024) OXY.com

Oxy Aims to Expand Lithium Tech to Arkansas (2024) hartenergy.com/

Occidental’s Lithium Technology Ready for Prime Time (2024) hartenergy.com

Occidental Petroleum and BHE Renewables JV to Revolutionize Lithium Extraction (2024) carboncredits.com

ExxonMobil drilling first lithium well in Arkansas (2023) corporate.exxonmobil.com

ExxonMobil announces plans to 2030 that build on its unique advantages (2024) corporate.exxonmobil.com

ExxonMobil plans to use direct lithium extraction in Arkansas (2023) cen.acs.org

Exclusive: Exxon aims to begin lithium production by 2026 in Arkansas (2023) www.reuters.com

Occidental may be reason Berkshire bought it. They also own BYD. Little tea leaves it please keep them coming