ABTC’s DOE 2025 Annual Merit Review Presentation for their $10 Million Grant

In 2023, American Battery Technology Company applied for and received a $10 million grant (total project is $20 million with $10 million in cost share) to develop three recovery and extraction technologies to be included in their cradle-to-gate lithium-ion recycling system. This specific component would be used in the Phase 2 stage, where the black mass and lithium intermediate produced in Phase 1 are processed into battery-grade metal sulfates and lithium hydroxide monohydrate.

Here is the project description from the grant award announcement:

American Battery Technology Company (ABTC) and its partners will validate, test, and deploy at pre-commercial scale three disruptive advanced separation and processing technologies to its existing lithium-ion battery recycling facility to further enhance economic competitiveness, reduce environmental impact, and re-integrate an even greater percentage of the constituent components to the domestic battery manufacturing market. ABTC will work in partnership with Novonix Group, University of Nevada, Reno (UNR), University of Utah (U of U), North Carolina State University (NCSU), National Renewable Energy Laboratory (NREL), Argonne National Laboratory (ANL), and Idaho National Laboratory (INL), and with downstream material validation and offtake by Dainen Material, Novonix Group, and iM3NY.

Since that announcement we were informed what the three process are in company investor and media presentations:

Active Anode Recovery and Regeneration

Liquid organic electrolyte separation

Non-thermal crystallization of cathode metal products

Beyond that, investors have received next to no updates, until this morning. A long term investor was able to obtain the publicly approved slide used for the Department of Energy’s Annual Merit Review (AMR) for the Vehicle Technologies Office (VTO). The purpose of AMR is to evaluate VTO-funded projects for their contributions to DOE’s mission and goals. While this slide is not comprehensive, it is the most detailed information available so far on the project and ABTC’s progress.

During the AMR, Kris Gustafson, Sr. Director of Technical Programs at ABTC gave the presentation.

Timeline

Project start date: 10/01/2023

Project end date: 03/31/2027

Percent complete: 33%

Current Budget Phase: One

Budget

Total project funding: $20,000,000

DOE share: $9,999,378

Contractor share: $10,000,622

Partners: University of Nevada, Reno (UNR), University of Utah (U of U), North Carolina State University (NCSU), National Renewable Energy Laboratory (NREL), Argonne National Laboratory (ANL), and Idaho National Laboratory (INL).

In the slide, none of the private companies that were part of the original grant award announcement are listed. It is likely that iM3NY is no longer part of the project, as they are in the process of being acquired by a third party and have faced several challenges. As for Dainen Material, they have not been mentioned in official company media since the announcement. As far as we know, only Novonix Group is still involved.

A brief summary of the project is to validate, optimize, and implement three advanced processing and separating technologies into an existing baseline pre-commercial lithium-ion battery recycling facility in order to increase its economic competitiveness, decrease its energy consumption and environmental footprint, and to reintegrate an even greater percentage of the constituent materials back into the domestic-US battery manufacturing supply chain.

Active Anode Recovery and Regeneration:

Project Goal: Demonstrate that graphite can be separated, purified, and regenerated from a mixed recycling stream, and re-graphitized back to its original performance

While most of the attention in lithium-ion battery discussions focuses on the cathode, where critical metals like nickel, cobalt, manganese, and the majority of the lithium are found, the anode also plays a key role. Sourcing material for the anode is becoming more of a challenge. The majority of the mining and processing needed to produce battery grade graphite is concentrated in one country: China. Years ago, when this issue was just starting to get noticed, I asked some early investors in ABTC what they thought about graphite. They laughed and said the company should consider making branded #2 pencils. At the time, that kind of response was pretty common. Graphite simply wasn’t taken seriously as a strategic material. That’s changed.

There are two main types of graphite used in batteries: natural and synthetic. Natural graphite is mined, mostly in China, which supplies around 65% to 70% of the global market. Other sources include Brazil, Canada, and Mozambique. Synthetic graphite is made from petroleum coke or coal tar pitch and processed at very high temperatures. China also leads here, mainly due to low cost energy and a large, established production base.

Right now, the U.S. imports nearly all of its battery grade graphite, most of it from China. That leaves the supply chain exposed to disruption, pricing shifts, and trade issues. It also raises environmental and ethical concerns. Natural graphite mining can cause water pollution and environmental damage, and in some cases, labor practices have been called into question. Synthetic graphite is even more energy intensive to produce, and in China, that usually means coal power. That contributes significantly to the overall emissions footprint of lithium ion batteries.

There’s very little domestic graphite mining or processing capacity in the U.S., and synthetic graphite production is limited by high energy costs and lack of infrastructure. That’s where recycling can play a role.

Graphite recovered from used lithium ion batteries can be reused with minimal performance loss, which makes it valuable in battery recycling. ABTC hasn’t released full details of its recovery process, but based on what’s in their slides and what’s standard in the industry, it likely involves froth flotation. This method separates graphite from black mass, the crushed material from spent batteries, by taking advantage of graphite’s hydrophobic properties. The black mass is mixed with water and chemical reagents, and air bubbles are introduced. Graphite attaches to the bubbles and floats, while heavier materials sink. The graphite rich froth is skimmed, filtered, and purified for reuse. The process is widely used and considered energy efficient.

After flotation, the bulk anode material goes through additional treatment to separate out remaining binder and silica. This includes purification and regraphitization, followed by steps like milling and micronization to meet particle specs for battery grade anodes.

Electrochemical testing, including coin cell fabrication, shows that the regenerated graphite ABTC produces performs on par with virgin material. In some cases, over 80% of binder and silica have been removed, making the recovered graphite suitable for reuse in new batteries.

Recycling graphite uses 30% to 50% less energy than producing synthetic graphite and avoids the environmental impact of mining. Cleaner production and recycling methods for graphite can help lower the footprint of battery manufacturing.

Liquid Organic Electrolyte Separation:

Project Goal: Demonstrate that liquid organic electrolyte compounds can be effectively separated from water with custom separation techniques

The electrolyte in a lithium-ion battery is a liquid solution that conducts lithium ions between the anode (typically graphite) and cathode (e.g., metal oxide), enabling the battery to charge and discharge. It consists of lithium salts dissolved in organic solvents, often with additives, to facilitate ion transport while preventing internal electron flow. Electrons move externally to power devices such as EVs, phones, or laptops.

Lithium salts such as:

Lithium hexafluorophosphate (LiPF₆)

Lithium tetrafluoroborate (LiBF₄)

Lithium bis(oxalate)borate (LiBOB)

are synthesized from lithium carbonate or hydroxide using chemicals like phosphorus pentafluoride or boron trifluoride. Production is concentrated in China, which supplies 60% to 70% of global output, along with Japan and South Korea.

Organic solvents including:

Ethylene carbonate (EC)

Dimethyl carbonate (DMC)

Diethyl carbonate (DEC)

Ethyl methyl carbonate (EMC)

are derived from petrochemical feedstocks such as ethylene and methanol through esterification or carbonylation. Major production occurs in China, Europe, and to a lesser extent, the U.S. Additives like vinylene carbonate (VC) and fluoroethylene carbonate (FEC) are synthesized from organic precursors, mainly in Asia and Europe.

Synthesis of LiPF₆ requires 50 to 100 kWh per kilogram due to energy-intensive purification. Solvent production uses 10 to 20 kWh per kilogram, and additives require 20 to 50 kWh due to complex reactions, though they are used in small amounts. Blending into electrolytes consumes 1 to 5 kWh per kilogram. Electrolytes account for roughly 10% to 15% of a battery’s total energy and emissions footprint, in comparison the mining and extraction of lithium contributes less than 5% to the total footprint of lithium-ion cell production.

The U.S. imports nearly all battery-grade lithium salts, solvents, and additives, with China accounting for the majority. Domestic production is limited due to the absence of specialized chemical facilities. Electrolytes are seldom recovered from spent batteries because of their volatility and reactivity. Most recycling focuses on metals, with electrolytes typically incinerated or neutralized, resulting in material loss and hazardous emissions. Degraded electrolytes form lithium fluoride and organic residues that complicate separation, and the U.S. lacks scalable infrastructure for recovery.

Recovering and re-distilling solvents and additives reduces the need for new chemical production and lowers import dependence. Reuse avoids emissions from new synthesis and prevents hazardous waste such as hydrogen fluoride and volatile organics.

ABTC is participating in a project led by Idaho National Laboratory (INL) titled Dimethyl Ether-Driven Extraction of Electrolyte and Solid Electrolyte Interphase from End-of-Life Lithium-Ion Batteries. Backed by a $250,000 grant, the project is developing a non-aqueous method for extracting unrecovered electrolyte components from spent batteries. Using dimethyl ether (DME) as the solvent, the process targets recovery of organic solvents such as EC and DMC, lithium salts like LiPF₆, and the solid electrolyte interphase (SEI), a passivation layer on the anode. DME’s low polarity and weak lithium coordination enable selective extraction without degrading materials, minimizing waste and emissions.

This is complemented by ABTC’s work (covered under this grant) in water treatment and chemical analysis for electrolyte recovery. In gram-scale trials, ABTC screens candidate materials and optimizes conditions to remove over 70% of organic content from water solutions. While details remain limited, the process likely addresses contamination from solvents and additives that leach into black mass and water during shredding. ABTC’s system removes these contaminants from black mass and treats water streams to extract the same compounds, improving purity and meeting environmental standards.

Together, these approaches enhance lithium-ion battery recycling by recovering electrolyte materials and addressing hazardous byproducts, including water-soluble fluoride species from LiPF₆ breakdown. These compounds contaminate black mass and wastewater and complicate purification. ABTC’s treatment method reduces these byproducts, supporting both potential domestic and existing international regulations.

Non-Thermal Crystallization of Cathode Metal Products:

Project Goal: Demonstrate that solutions of cathode metals can be crystallized into hydrated powders that meet rigorous battery cathode grade specifications utilizing nonthermal crystallization techniques.

Crystallization is used to purify and form solid crystals from a solution, commonly applied to isolate high-purity materials such as nickel sulfate, cobalt sulfate, lithium carbonate, and lithium hydroxide monohydrate. These materials are essential for lithium-ion batteries, as they are used in cathodes. Crystallization involves dissolving a substance, then adjusting conditions to grow solid crystals, similar to forming sugar crystals from a sugar solution.

For lithium-ion batteries:

Metal sulfates (e.g., nickel sulfate NiSO₄ and cobalt sulfate CoSO₄) are used in cathodes for NMC batteries, found in EVs and electronics.

Lithium carbonate (Li₂CO₃) is commonly used in LFP batteries for energy storage and lower-cost EVs.

Lithium hydroxide monohydrate (LiOH·H₂O) is preferred for high-nickel NMC batteries due to improved synthesis at lower temperatures.

Traditional crystallization is typically thermal and involves these steps:

Dissolving raw material: Compounds are extracted from ores or brines and dissolved using water and chemicals (e.g., acids), forming solutions such as lithium sulfate.

Concentration via evaporation: Heat is used to evaporate water, concentrating the solution to surpass solubility limits and form crystals. For lithium carbonate, sodium carbonate is added to a lithium solution to precipitate crystals.

Crystallization: The solution is cooled or treated with agents like ethanol or sodium hydroxide to grow crystals. Conditions are controlled to ensure proper crystal size and purity.

Separation and drying: Crystals are filtered, washed, and dried to produce a final solid suitable for battery manufacturing.

Thermal crystallization is energy intensive, consuming hundreds of kilowatt-hours per ton of product. On a large scale, energy expenses are significant due to heating and drying requirements.

Environmental Costs of Thermal Crystallization

Emissions: Fossil-fuel-based energy can lead to 5–15 tons of CO₂ per ton of lithium carbonate.

Water use: Large volumes are consumed and lost as steam, especially problematic in arid regions.

Waste: Chemicals like sodium carbonate or acids produce byproducts needing proper disposal.

ABTC has developed a non-thermal crystallization process to produce battery-grade lithium hydroxide and metal sulfates while reducing environmental and energy costs.

ABTC’s approach replaces heat-based evaporation most likely with alternative methods that use chemical agents, solvents, or techniques such as pH adjustment or pressure changes to trigger crystallization. For example, agents like ethanol may be used to induce precipitation without boiling water. The method purifies the solution and produces battery-grade crystals (e.g., NiSO₄, CoSO₄, LiOH·H₂O).

Demonstration: Modeled and demonstrated at gram scale, successfully producing high-purity crystals.

Energy and water savings: Cuts energy use and water loss by over 20%, avoiding evaporation.

Cost efficiency: Reduces production costs and increases profit margins by over 10% through lower utility use and streamlined processing.

Environmental advantages:

Emissions reduction: Lower energy use means reduced CO₂ emissions, especially with renewable energy.

Water conservation: Less evaporation preserves water resources.

Lower waste: Potentially fewer byproducts if reagents are recycled or minimized.

Current Status of the Project:

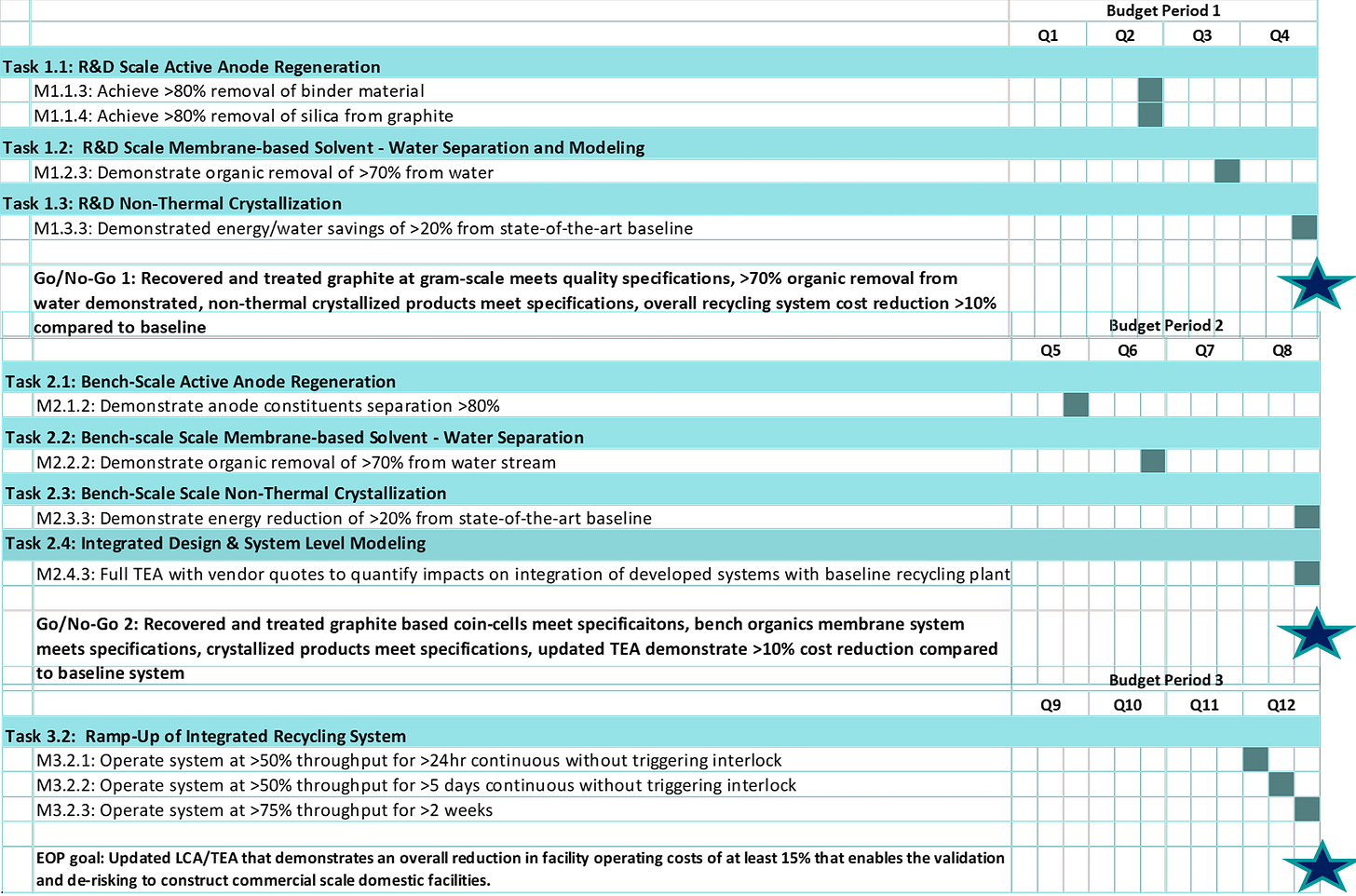

From the slide ABTC is saying they have meet all required metrics to move forward from Budget Phase 1 to Budget Phase 2. With these specific metrics completed on 3/31/2025.

Recovered and treated graphite at gram-scale meets quality specifications

>70% organic removal from water demonstrated

Non-thermal crystallized products meet specifications

Overall recycling system cost reduction >10% compared to baseline

ABTC and its partners have achieved all required metrics for movement into Budget Period 2 and are awaiting feedback on its Continuation Application.

Each Budget Phase will have certain goals that must be completed in order for the project to move to the next phase. What is interesting is that it seems some of the metrics for Budget Phase 2, like the coin cell validation, have already been accomplished. But ABTC has been validating their products for some time, so it seems reasonable that they would go ahead and include the graphite samples in this process.

What the company sees as the challenges they need to overcome to complete the project funded by the DOE grant:

Development of internal and subrecipient work plans for Budget Period 2 to implement lessons learned from Budget Period 1 and support process optimization. This requires coordination across all project partners to refine responsibilities, improve communication, and ensure more efficient execution moving forward.

Consistent feedback loop with techno-economic analysis and life-cycle analysis to help drive process optimization in Budget Period 2. This involves using ongoing performance and cost data to inform design decisions and improve environmental and economic outcomes.

Educate and engage with ABTC internal engineering and construction teams for the development of design packages in Budget Period 2 for the eventual procurement and construction of the pre-commercial demonstration systems in Budget Period 3. This includes ensuring the teams have a clear understanding of technical requirements, project objectives, and delivery timelines.

Troubleshoot and overcome any global supply chain or field-related issues during Budget Period 3 to construct, commission, and ramp the pre-commercial demonstration systems. This involves identifying potential disruptions early and implementing solutions to keep construction and startup activities on schedule.

South Carolina:

Now several times, including in this presentation, the Tahoe Reno Industrial Center (TRIC) facility is referred to as a pre-commercial facility. While they are well beyond pilot levels, the company is treating this site, it seems, as a glove box site, what the original Fernley GDC was meant to be. It is where R&D is done while still producing a product for commercial sales. This is further reinforced by the final section in the slide. These three ancillary systems will be built into Phase 2 of the TRIC facility and then, once fully validated, will be incorporated into the South Carolina facility, which is the planned 100,000 metric tonne per year feedstock facility that is being partly funded by a $150 million DOE grant.

The update about the South Carolina site is that they are in the initial infrastructure design stage, even though no announcement of actual land purchases has been released. They are starting the process of ordering the materials and equipment that have long lead times, such as transformers and control units. They specifically say they will break ground in early 2026, but of course added that may change based on funding.

Conclusion:

While still scarce on details, this slide from the DOE’s annual merit review shows that ABTC has made progress on the $10 million grant to add three systems to their recycling process with the goals of reducing waste and environmental impact, lowering operating costs, and increasing revenue by recovering and profiting from more materials in a lithium-ion battery.

We also learn that they plan to break ground in early 2026 for what will be a full commercial-scale lithium-ion recycling facility, and that they are in the initial stages of the project.

The slide will be available for download, once they upload it to this DOE webpage:

https://www.energy.gov/eere/vehicles/annual-merit-review-presentations

Disclaimer: This article is intended solely for educational purposes only and should not be construed as investment advice, a solicitation to buy or sell securities, or a recommendation of any investment strategy. The author has not received compensation from any companies mentioned and is not responsible for decisions made based on this information. Readers are encouraged to consult primary sources and professional advisors before making investment decisions.